Exasol: Snowflake On A Budget

EU Small & Mid #2

I believe Exasol is very cheap, and that the fundamentals of the business are much better than one would think at first glance.

The database technology market

Big Data is currently the most important driver of innovation and productivity. Its collection and analysis has enabled new business models and refined a lot of the legacy ones:

Trading becomes high-frequency

SEO & E-commerce

Healthcare decision makers can observe situations in real-time

However, the problem of feasibility became omnipotent. Some business models are theoretically possible, however, practically infeasible due to the cost of maintaining readily-available data and the speed with which data can be accessed.

Therefore, businesses that build technology which improves on the two aspects mentioned above have the potential to create value for their customers and generate profits by capturing a share of it.

According to Exasol’s prospectus, this market is worth about 169b USD in 2018, of which 25-30% can be serviced by Exasol. Depending on the end market, it is growing between 15 and 30% per year, with healthcare being the fastest growing segment.

Exasol’s core product

Faster

Exasol’s product is quite different from the competition. It is an “in-memory” analytical database, meaning that it stores data in RAM. This is important, as it allows data to be accessed much faster. The way it accomplishes this is by optimising, never storing 100% percent of data in the RAM, but rather using an algorithm to decide what percentage of data is needed in RAM to get the best performance.

Source: Fastest Petabyte Scale SQL Databases on the Planet – Under the Jargon

Built for Speed: Exasol versus the competition - YouTube

Flexible

Exasol can be installed in a short amount of time, on-premise, or in the cloud, compared to competitors which are all in the cloud.

Benefits from improving hardware

Exasol’s value proposition is that it optimises data access for a given hardware environment. This means that as server providers compete to give the best technology, Exasol’s product will automatically deliver more value to its customer, as algorithms adapt to the new environment.

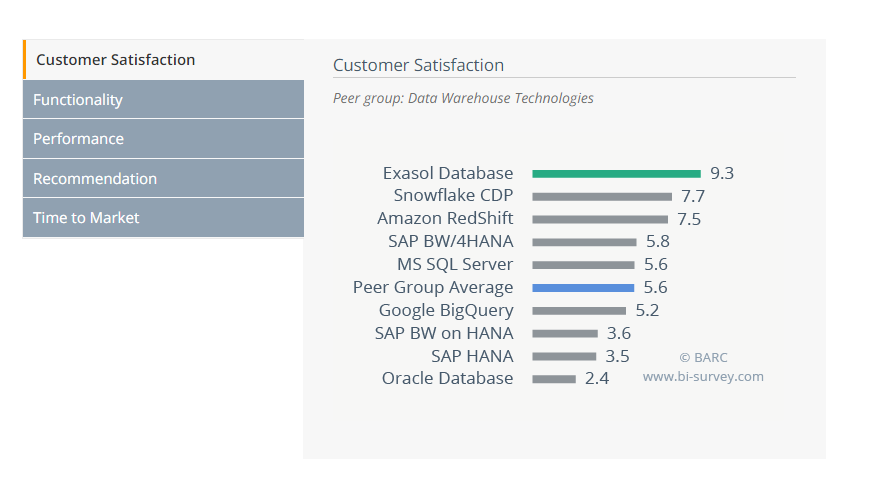

Exasol Database - BI Survey (bi-survey.com)

Competitive positioning/Advantages

Fills the gap that snowflake cannot address

Snowflake is the main competitor to Exasol. The value proposition is that one pays in function of usage. This is perfect for businesses with cyclical use of data warehouses, which is most common. It costs less and scales better in most cases than Exasol, according to reviews.

However, Exasol’s performance make it most attractive for a specific niche of businesses that meet the following criteria:

Cannot compromise on speed and performance

Non-cyclical use of data

On-premise for security reasons and not willing to move to cloud

A few examples:

Quantitative Hedge Funds: They are always trading and cannot compromise on speed

Healthcare: Given the stakes, better performance cannot be ignored

E-commerce: They are in constant need of optimising

This is why Exasol’s strategy is focusing on those three markets. Some successful client acquisitions include the Otto group and major healthcare and financial institutions.

A very tangible proof that Exasol is the best for a niche is the Amazon Partnership. Amazon has its own solution, Redshift, so a partnership with Exasol clearly shows that Redshift cannot accomplish what Exasol can in some cases.

High Switching costs

For the type of businesses mentioned above, switching away from Exasol could prove very costly. Once everything is running on RAM, everything would need to be shut down in order to switch.

Potential TAM expansion

It is worth mentioning, that there is a bull case for TAM expansion as hardware improves. Since Exasol’s product is designed to optimise hardware use, better hardware will allow it to do more for its users, potentially convincing an increasing number of businesses to switch.

Why is the stock down so much ?

Exasol came public in March 2021 last year and reached a high of 26 euros per share. However, the stock is currently around 6.5 euros, down 75% from its highs.

I believe that 3 reasons led to this decline, and that they are all temporary:

Sentiment

European markets are much less forgiving than the American markets. The culture of SaaS investing is much less common. Also, a general negative sentiment against profitless tech has been developing since the beginning of 2021.

Financials

Though ARR is compounding in the 30s, revenue has been much more volatile. This is due to one-time benefits that Exasol experienced in the past years, and the fact they only fully transitioned to SaaS recently.

Just looking at the top-line on Bloomberg shows a very different picture than actually digging into the underlying numbers:

Business mistakes

This is probably the most important reason.

Until last year, Exasol was more a start-up than an actual international business. Amazingly, the business is completely bootstrapped, which means they didn’t have the luxury of burning through VC cash to spend on marketing.

However, when they IPOed, they got too much money to soon and blew it on subpar investments that raised their CAC without really showing any returns. They were not used to being rich and that really caused them to make a lot of mistakes and burn 80% of their cash in 36 months.

Why I believe they will turn the ship around

Having talked to management, they learned from their mistakes, say that they won’t require any capital raise and are confident to reach profitability by FY 2023. I believe they will manage to do so because of their past as a bootstrapped business - they already now how to grow in a profitable way.

Instead of spending too much on customer acquisition, they will focus on slowly bringing high-value customers in their target niche, while growing their revenue per customer. Once they reach a scale at which they can be profitable, they will accelerate marketing again and growth rates will pick up.

Underlying Economics

LTV to CAC

On average, I estimate that if we exclude 2021, it has cost them 200,000 euros on average to acquire a customer. Churn rate has been less than 5%, and they typically retain the bigger customers. Net dollar revenue retention is 121%, climbing from 113% a year ago.

They currently make around 150,000 euros per customer per year, so assuming a customer stays 20 years and that gross margins stay around 96%, they make around 2,88m per customer, or a 14.5x return before opex. Also, their revenue per customer keeps climbing, so this is likely to rise.

Overall margins

Margins are a mess, however, they have been able to grow ARR at 15% while keeping EBIT over 10% in 2017. So assuming they scale like they want to, this is likely to be the bear case for 2026.

Outlook

ARR growth

Management targets 100m in ARR by 2026. I believe that ARR will grow 20-25% p.a in the next two years and then accelerate once they break-even in 2023.

Margins & Cash

Margins are anyone’s guess at this point, but one thing to keep in mind is that they can achieve this growth without spending more than 15% of revenues on marketing. Assuming 95% gross margin, 80% of revenues come in before R&D, admin and D&A. I don’t see why they wouldn’t be able to reach at least 20% operating margins in the long run. Also, they do not have stock-based comp, so this is all cash, but we aren’t diluted.

Finally, they have 27m euro in liquidity, which I think will be enough to cover the next 2 years of cash burn. However, there is dilution risk if it isn’t.

Valuation

Now this is where the whole trade idea really lies: Exasol currently trades a 5x forward sales. Snowflake trades much higher. Sure, it has the largest TAM/fastest growth, but does this really warrant a 5x higher multiple?

If 100m in ARR is achieved by 2026, it is currently trading a 1.5x 2026E sales. If one assumes in the base case that they make 20% operating margins and will still be growing double digits in 2026, they could be trading at 10x Sales pretty easily, netting a cool 46% annualised return for the investor. Even if they dilute 10-20% to raise money in the short term, this is too attractive to ignore.

Final Thoughts

I am not claiming to be an expert in this field, so take this with a grain of salt.

To me, it seems that Exasol is undervalued by a large amount. There is clear evidence that their product creates huge value for a niche of companies in a multi-billion dollar, fast growing market. This supports management’s 100m ARR target. Execution was pretty terrible recently, but the reasons for this are easy to understand and can be overcome given the history of the business, making me confident that they will be able to deliver.

Assuming they deliver, the stock is trading at 1.5x 2026E sales, compared to the 10x average SaaS multiple, and the business is definitely not under-average.

Therefore, the risk reward is attractive with over 6x upside, and the downside is in my view only limited to potential dilution, as the value creation and competitive edge is very strong.

Disclaimer: I am Long