B&M: The Treasure Hunt

EU Small & Mid #1

B&M ($BME) is one of the most resilient compounding machine in the retail space. Furthermore, the market perceives it as a low quality asset, allowing us to enter at an attractive valuation.

Share price at the time of writing: £5.50p

A compelling growth story

B&M was founded in 1974 as “Billington & Mayman”. However, the chain really took off in 2004 when it was acquired by the current owners, the Aurora Brothers.

The model is that of a discount retailer used for complementary shopping, drawing in people with great bargains and cashing in on impulse buys.

The Aurora Brothers grew the business 20-fold by 2022 into the second biggest discount retailer in the UK, with a nascent position in France.

It came public in 2016, and since then, has had a very consistent track record of growth.

This has translated to a 100% increase in the stock price over the past 5 years, and a 17% total annualised return including dividends.

However, the road has been a bit bumpy. In 2016, they bought a German discount retailer “Jawoll”, which they sold in March 2020. This acquisition has not worked out well for them, due to the differences between the German & English spending habits. Also, they were highly leveraged at the IPO.

Nonetheless, the two other acquisitions made during its public existence (Babou in 2019 and Heron in 2018), were quite successful, and B&M has had a great track record as a private company.

Moreover, the core B&M franchise has compounded a steady double digit rate, protecting the company’s financial performance.

The current business

B&M operates in 3 segments:

B&M UK (85% of Sales, 95% of EBIT)

Heron (9% of Sales, 3% of EBIT)

B&M France (6% of Sales, 2% of EBIT, previously Babou).

The B&M franchise is the original model, and Heron is a discount grocer that was acquired in FY 2018. As you probably expect, the vast majority of the business’ value comes from the UK franchise.

The group currently does about £5000m in sales and £600m in EBIT, implying a significantly above market profitability for a retailer (12.8% operating margins). Also, growth is far from over, as the franchise only has 681 stores in the UK and 104 in France, whereas peers have up to 1500.

This is certainly impressive, but what gives? In the following section, I explain their moat and why their business model has proven so successful.

B&M’s Moat

Cost advantage #1 : Narrow range, deep volumes and direct relationships with China

B&M has a direct relationship with its suppliers in China, from which it sources 30% of its products (most of non-essentials, ie. the higher margin items). Generally, most retailers have 2 to 3 intermediaries in the supply chain, scraping a few percentage points at each step.

Furthermore, the range of product sold is very narrow and constantly optimised to sell large volumes of the best-selling-products.

B&M benefits from deep discounts, enabling the business to undercut the competition on average by 30%.

Cost Advantage #2: Capital Light Model

B&M leases all stores and keeps initial capex to the bare minimum. For a typical B&M store of 20,000 sqf, B&M spends around £600k. They tend to open around Christmas as this is when the foot count is the largest. I estimate that on average, a store brings in £6m per year, and can operate at 12-14% operating margin excluding corporate costs. Thus, a store pays back the investment in 8-10 months on a cash basis.

This explains how B&M has managed to grow store space at a ~20% CAGR over the last 10 years without sacrificing cash generation.

Brand Recognition: The Treasure Hunt

B&M refers to the process of a customer going in-store as a “treasure hunt”. This is because their business model is based on impulse buys. The customer is lured in by bargains on essentials such as till-rolls, gets lost in the store, and ends up buying discretionary items.They estimate that on average, a customer leaves a store with a basket size several times larger than expected.

Also, the business has nothing to fear from online: Customers go in store because they know they will find bargains, they don’t have a specific idea that they could search for. Moreover, B&M is also 30% cheaper. And that matters a lot to their typical lower income customers.

Those three advantages create a compounding machine

B&M has built a reputation for being a place where bargains are found, while managing to extract high value impulse buys from customers.This formula has allowed them to gain market share in till-roll and grocery while sustaining much higher margins than your typical grocer.

On the other hand, the capital light model allows for both cash generation and 2x over market growth in store space. Consequently, their return on invested capital is consistently in the double digits, which is abnormal for a discount retailer.

Narrow range, deep volumes

Mid Term Outlook

Store growth

37 net new stores per year in the UK, 13 for Heron and 10 for B&M France. This is in line with management guidance.

Organic growth

I assume 2023 will see 2% same store growth driven solely by store size growth, and then accelerate to 5% which incorporates 2% store size growth and 3% of above market consumption growth.

Margins:

Covid has surprisingly benefited B&M. LFL sales grew 24% in 2021. The reason is that higher income customers, relocating away from cities, came in to shop for home ware. Obviously, they bought the higher margin stuff, so margins shot up from 10 to 13%.

In my opinion, there are both non-recurring and recurring effects. On one hand, some of the sales were one-off in nature, as shown by declining LFL sales in 2022 so far (I estimate -3%).

However, I believe that around half of these new customers will return regularly, allowing B&M to operate at higher margins than before. This is seconded by management, which tracks the behaviour of their customers. I assume margins will go down to 12.3% in 2022 (we already have 3 quarters) and further down to 11.8%. This is around 150bps higher than the average margins of B&M UK in the past.

Long term, there is further upside for margins as B&M France grows its same store sales to the level of B&M UK. France is currently performing well, winning a survey for the best franchise and posting double digit LFL growth.

Another surprising tailwind is inflation. B&M is a price-taker, aiming to keep a discount relative to its pears. It follows the price increases in magnitude. However, due to its much leaner operating model, it may see margin expansion or even increase the discount to gain market share !

Key operating metrics:

Valuation

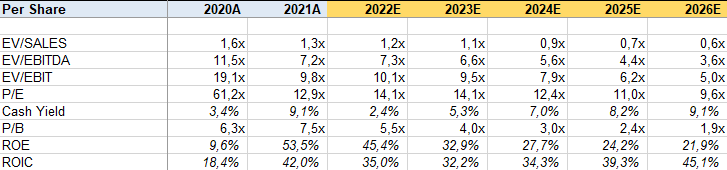

At a valuation of 10.1x EBIT currently, I believe that B&M is certainly too cheap.

Below are the forward multiples assuming a full cash sweep for debt pay down, and that the current EV is comprised of existing debt and a new senior note issued in November.

I assume the current multiple is baking in the lower cash generation in the following years. Therefore, in my base case multiple expands to 12.0x EBIT, given a forward outlook that is more favourable.

The equity value shows 100% upside using full cash sweep.

The IRR, assuming constant debt, shows 19% return per year up to 2026.

As advertised, the return comes mostly from revenue growth and cash generation, not from multiple.

For a 4.25 year hold, this is a very good return, and the risk is low. The IRR in the Bear Case, assuming the business goes back to 9.5% EBIT margin, is still 5%!

Macro-Sensitivity and Risk

B&M is a value and defensive stock. It has outperformed well in the downmarket, due to its perception as a sticky discount retailer, selling essentials. Furthermore, it is completely immune to inflation and supply chain pressures due to to its superior operating model, and has proved it over the last few quarters.

This begs the question: What if the economy is actually booming? Won’t it under-perform?

This is where the general perception of the business is deceptive. Though B&M attracts clients with essentials, it makes the most money selling discretionary items. Thus, it actually does benefit tremendously from a wealthy consumer in an up-market. And in a down-market, it will compensate the lost sales by gaining market share as the average consumer looks for bargains.

Think about it, any low income consumer would rather pay cheaper for the same product regardless of the economic environment. However, middle-class consumers are more likely to look for bargains when things get tougher.

Concluding thoughts:

B&M is the highest position in my portfolio at cost. I think the business will continue to outperform the market, due to the low valuation and the high quality.

I believe markets do not appreciate how sticky and resilient this business is. Covid was a a tailwind, Inflation is a tailwind and E-commerce cannot compete with this type of model due to the “Treasure Hunt” aspect. Agreed, it’s not the sexiest model in the world, but it’s bulletproof.