Higher Yields, Tankers, Insurance & A Biotech Bear Market

Small Caps Earnings Review 13/05/22

FinecoBank (mcap 7548m€)

When’s the last time you switched brokerages ? Yeah. Never happens. That’s why they are generally great businesses to own.

FinecoBank, as the name would suggest, is a bank, however, I view the business as a brokerage that also offers banking services. It’s much more sticky.

The business had a blow-out quarter. Net financial income is up 43% y-o-y and 70.9% q-o-q. Not a surprise, given that higher rates allow Fineco to reap significant incremental returns on their treasury. The CEO estimates that they make 150m extra per year per 100bps move in the 10-year bond yield.

Furthermore, trading revenue continue to be strong, as the CEO highlights that he believes we are now in a new regime characterised by structurally higher volatility.

Investing related revenues are down, which isn’t a surprise considering that most markets are down big, decreasing AuM. However, AuM is only down 5% in the quarter, owing to the strong pace of asset growth which has offset the decline in principal.

Overall, revenues are up 23% both q-o-q and y-o-y, and net income is up 30% y-o-y, as operating leverage continues to be strong with operating costs only growing 4%. One thing the CEO notes is that since the platform has been developed internally from the ground up, they are relatively shielded from IT cost inflation.

The additional revenues from treasury management, along with the great performance of the other business lines, have contributed to an increase of >500bps in ROE (28%). FinecoBank has averaged 18-20% in the last 5 years, so you can see how important the impact of higher rates in Europe are on the intrinsic value of this stock.

Cary Group (mcap 6658m SEK)

Cary group provides point of sales where customers can repair their windshields and a platform with automates the claims of customers insured by their partners. It has taken over the Swedish market, and decided to IPO in 2021 to fund its European expansion.

The method: Pac-Man. If any of your relatives own a windshield repair shop, they’re interested. Year-to-date, they acquired GlassCo Sa in Portugal and Charles Pugh in the UK, for a total consideration equivalent to 20% of their market cap.

Sales are up 65% (7% organic), owing to acquisitions made in 2021, however, operating income is essentially flat. The stock was down roughly 20% after earnings.

I think that the market realises that the windshield repair business is significantly worse in Europe than in the Nordics. In fact, I estimate that margins are at best 10% in Europe vs 20% in the Nordics.

Thus, leveraging the business at 4x LTM EBITDA to enter significantly less attractive markets is perhaps a bit reckless.

Euronav: (mcap 2081€)

Euronav operates tankers, the ships that transport oil. Yeah, you most likely don’t care, and I can understand. However, I think you should, because this stock is bucking the trend, and there are reasons to expect it will continue to do so as the Russia-Ukraine war has completely changed the rate environment.

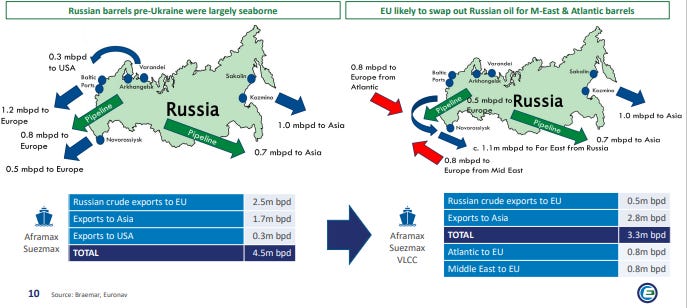

The Aframax and Suzemax tankers that typically sailed from Europe to Russia and back were forced to change routes as their usual route ceased to exist. Russian oil was now to be shipped all the way to China, and European demand was redirected to the Middle-East.

So the volume decrease impact on profitability stemming from a waning reopening dynamic is expected to be more than offset by an increase in ship utilisation and rates.

Moreover, the tanker order book is at a 25 year low and the fleet age at a 20 year high. Last time this happened, the shipping industry went into a huge bull run. Sure we are missing the Chinese growth that drove most of the speculation in 05-08, but once the Chinese economy recovers, rates could go very high very fast. That’s why you should probably pay attention to shipping in the next few years.

Also, a merger with Frontline is on the table to consolidate the tanker market, but I haven’t looked into it to be honest. I might do a piece on it in the next few days.

Secunet Security Networks: (mcap 2222m€)

The German government has announced a 100B€ defense spending plan in response to Russia’s invasion of Ukraine. It’s not surprising that the stock of a company that generates most of its revenue from government contracts related to IT security would go up.

Setting that element aside, the business is also a pretty good compounder, as sales and profits are up 3 and 4x in the last 5 years respectively.

So, the Q1 earnings were highly anticipated by the market. However, I’d argue that they were pretty disappointing. The company hasn’t raised guidance, and there is no reason to believe that the company will benefit from the spending plan in the short term.

The stock is currently trading at 40x forward EBIT.

Evotec: (mcap 4265m€)

Evotec has been paying the price of the strategic decision it made a few years ago: evolving from a trial-admin outsourcing company, a great business with decent margins, into a business that also takes trial risk and leverages its equity to fund trials.

The recent months have been disastrous for biotech, over 1/3rd of them are actually trading below cash. As a lot of the company’s value is locked into assets that are largely dependent on lenient capital markets to raise capital through IPOs, it is no surprise that the stock is down 44% year-to-date.

On the other hand, the earnings call had more of an upbeat tone. The company has prolonged its deal with Brystol Myers for 8 years, which could bring an additional 5b€ in revenues. 200m€ are expected to be booked in the short term as an upfront payment.

Revenues are expected to be 700-720m€ in 2022, but this was pre-BM deal guidance. They will likely be much higher.

If one is bullish on Biotech, Evotec provides exposure to a diversified basket of biotech investments, selected by a company that has an informational edge, but also to a strong outsourcing business that is profitable and growing >20% per year.

Is Evotech offering anything unique compared to WuXi or any other CRO. Even if evotech offers better serves they can't beat Asia due to cost right ?