Mips AB

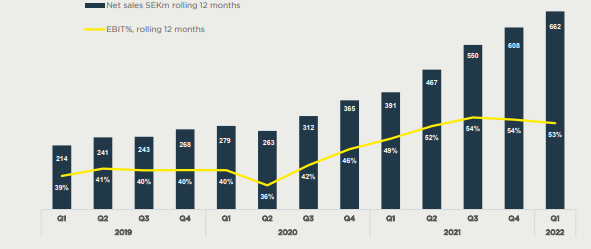

The Swedish growth machine continues to show outstanding results. Sales are up 65% in Q1 22, with organic growth at 48%. Operating margin stands at 45%, and operating income is up 55% year on year. Stripping out exchange rate effects, MIPS continues to show operating leverage on its organic growth, which is very impressive given the helmet safety solution’s high level of margin.

However, Q2 & Q3 are bound to be difficult comps. This may provide a very attractive entry point later in the year, as the valuation is somewhat tough to justify at 50x 22E earnings. MIPS has already penetrated 10% of its adressable market, which grows at a mid-single digit rate. Optimists think it can get to at least 30% in a relatively short amount of time, and the business has plenty of room to raise prices & develop more solutions to increase its TAM.

Nevertheless, the ultimate constraint of market size and growth will hit the share price at some point, something to keep in mind.

Lumibird SA

The business grew 11% in the first quarter pro-forma, led by Lidar (26%). Growth in this segment is supported by demand from the defense industry.

Management has re-iterated its target of 250m€ in sales in 2023 (2021: 162m€) and a 20-25% EBITDA margin (20% currently).

The 30% EBITDA CAGR seems pretty ambitious, and the market seems to agree, as it is only trading a 20x 22 EBITDA. Perhaps this is an opportunity?

NCAB AB

The swedish PCB supplier’s sales are up 85% in Q1, with 20% growth in the order book( 8% constant currency).

Management has given a new 2026 target of 8b SEK in sales, compared to 4.4b SEK expected for 2022, implying a 16% revenue CAGR. Half of the growth is expected to be organic, and half is to be acquired. Management has a history of delivering on its promises, and the market is rewarding the stock for that (28x EV/EBIT for 2022, a high multiple for a distributor).

Supply chain issues are likely to persist another year at least, increasing the bargaining power of companies such as NCAB, so we could expect pricing to make up most of the organic growth.

Finally, the question of their russian business (5% of EBITDA) was resolved with a sale to employees. They took a 34m write-down in Q1 for this loss.

Focusrite PLC

Sales are down 9% organcially in H1 22, and 2.5% overall including Sequential. The performance of the individual brands in the portfolio was quite disparate however, with big-ticket, cyclical items such as Novation & Adam Audio down 19% and 33% respectively, and Adam Audio, the concert equipment maker, up 44%. This underlies the strength of the diversification strategy.

Focsurite’s core product, the audio interfaces, was down 10%. However, a strong highlight was the performance of Amplify, the audio software subscription business (not reported separately). Subscriptions were up 245% during the period.

The adjusted operating margin (ex. PPA and Sequential acquistion costs), was >20%, with component shortages negatively affecting hardware margins. This confirms a key element of the thesis: operating leverage driven by product mix, unit volume & vertical integration.

Comps will ease in H2, and management has re-affirmed the target of modest growth for 2022.

Here's a link to my investment thesis on Focusrite

Exasol AG

Exasol provided its first quarterly update for Q1 2022. Overall, ARR grew to 28.5%, on track to meet 38m€ for the full year (24% y-o-y).

Operating loss halved compared to Q4, and management expects cash to be in the range of 10-12m € at year-end. This confirms the ability of management to grow in a profitable way, which I inferred from their bootstrapped inception.

Exasol remains cheap @ under 4x EV/2022E sales, in fact, it got even cheaper compared to when I posted the trade idea a few weeks ago. Link here

Again, the opportunity is very interesting, if management executes and delivers on 100m€ ARR in 2025 and profitability, without dilution. For now, we’re on track, ARR grew 27% in 2021, and is expected to grow at roughly the same rate in 2022. However, they burned 42m€ in 2021 vs 14m€ expected in 2022.