Long Gini Coefficient & Cloud

Small Cap Earnings Review 19/08/22

Watches of Switzerland - GBP 1984m

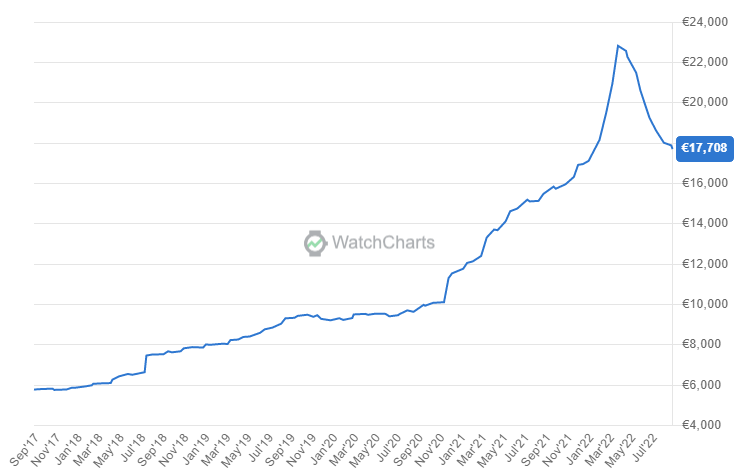

In the last few years of the everything bull run, luxury watches have been a notable outperformer. A basket of selected models from the most popular brands has appreciated 25% per year on average in the past 5 years.

Luxury watches have economic characteristics that make them really good stores of value:

A limited supply ensuring people stay on a wait list multiple years

An intangible “savoir-faire” & brand value

A high cost to produce, both in terms of time, labour and capital.

An association with success

Aesthetics

Watches of Switzerland (WOSG) is the premier distributor for Rolex & has ties with some of the most in-demand watchmakers (ie. Audemars Piguet, Patek Phillipe). The watchmakers want to trust their distributor to maintain the high standards in stores & in terms of service in order to nurture the brand image. So, it is unlikely that those relationships break down , as watchmakers also prefer not to sell their own products themselves.

Thus, WOSG enjoys a desirable moat. In exchange for keeping high store standards implying high levels of capital expenditure, it sells products that appreciate over-time and need no advertising.

WOSG is primarily based in the UK, however, the strong growth in US demand has prompted a US expansion. Through price increases (at the watchmakers will) & the US store roll-out (through acquisitions & new openings), growth is expected to be around 15% p.a over the next few years.

Q1 22 Sales were up 25% YoY on a constant currency basis. Though the FY23 guidance was underpinned by a conservative tone given the macro, WOSG remains a secular growth story enjoying a competitive advantage in one of the best industries.

Trading at <15x FY23 EBIT, its perhaps time to hoard some shares, for a leveraged bet on the Gini coefficient.

Artnet - 47m€

Artnet has been running an online art marketplace for the better part of the last two decades. Over time, the company has build customer trust, and expanded its offering:

Artnet Network: access to galleries for a membership fee

Artnet Data: Access to years of art prices

Artnet Advertising

The latter is what caught my interest. It is a recently launched line of business, and grew 72% YoY in H122 representing 30% of sales (vs. 8% overall growth).

As Artnet has a network of verified high net worth individuals interested in luxury goods, it is therefore one of the best places for luxury good makers to advertise.

Artnet has an annual user base of 50m people and 8m annualised revenue from ads represent a 20c per user monetisation. There is still lots of room to improve that, accelerating revenue growth.

It is currently trading at 1.5x FY22 sales.

Exasol - 103m€

Exasol’s share price tanked 50% since I posted my long thesis. Ouch.

However, I still stand by my trade idea, as the fundamentals of the business give me no reason to doubt it.

Q2 earnings were good overall, but some elements could be better.

The positives:

Exasol continues to win high-profile clients (ie. Credit Suisse during the quarter), and management indicates that they are confident in meeting their 38-40m€ ARR target (~ 35% YoY), on the back of the deals they expect to close before year end.

Exasol won 19 net new clients in the last 12m in Europe (15% growth), continuing to show that they have this market figured out

Existing customers grew their usage by 17% on average, as they are happy with the product and expand to new use cases.

Management made an interesting point about the cloud diversification trend they are starting to witness: large businesses do not want to work with as single database provider as this would concentrate risk. This may create some relatively easy new wins in customers using Snowflake who want to diversify.

Cash burn is in line with expectations

The negatives:

There is really one big negative aspect to this report: the performance in North America. Exasol won a client, but also lost a client, whereas existing customers only grew their usage by 3%.

This isn’t extremely surprising, North America is a competitive market, and they don’t have the sales team to make a dent just yet.

However, they hired a sales VP from Teradata to lead the new NA sales team, so I have to give them a bit of slack, it could improve significantly in the next few months.

Overall, everything is going as expected, and though the NA performance is a bit disappointing, its not an essential part of the base case and has significant room to improve.