Wise PLC (Previously known as Transferwise) is on a mission to lower the costs of cross-border payments to 0. Scale is the name of the game, and though wise has a number of competitors in the payment ecosystem, it is the only pure cross-border payment platform with scale and is able to offer an unbeatable value proposition. With only £74B out of the £18T of cross-border flows going through Wise, there is still lots of room to grow.

On a mission to lower costs: How Wise wants to grow by shrinking the market

An unbeatable value proposition

Wise was founded in 2012 by Taavet Hinirkus (who was also Skype’s first employee) and Kristo Käärmann. The two Estonians were fed up with the high fees charged by the banking industry, which they experienced first-hand sending money to Estonia.

Ever sent money abroad using a bank ? Then you probably know what I am referring to. You don’t know how much its going to cost, and when you discover how much it cost you after the fact, you probably always think to yourself: How is it possible that I lost 5% of money just to move it around?

Furthermore, you never know when it’s going to arrive, and often it takes days. When you have a problem, or want to enquire on the payment status, you have to deal with what is often a clueless customer service.

The point is that the service is very poor, and customers are aware of it. So its not surprising that a firm offering the following service is eating market share so fast:

95% lower fees, instant/one day transfers

full transparency,

A convenient experience through their app

Integrating with your bank so you don’t even have to switch platforms

From individual customers to business clients

Initially, Wise was really focused on solving the problem of individuals sending cross-border payments. You would download the app, connect your credit card/bank account, create a profile for your receiver, get a quote, send money and that was it.

Then, Wise created the “Wise account”, where you could hold many different currencies in a similar fashion to Revolut. They also added a debit card to the package.

Finally, Wise also launched a “Wise Business” version, which includes all the elements of the Wise account + some additional services tailored for businesses such as: invoicing, multiple accounts, mass payment systems. This is aimed at freelancers and SMBs, and brings in the opportunity to charge other fees annex to pure cross-currency transfer.

Currently, Wise derives >20% of its revenue from business accounts and 80% from individual customers, a ratio that has been pretty stable over the years as both are growing very fast.

A long runway for growth

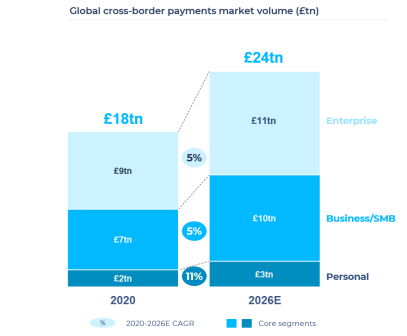

The global cross currency payment volume is expected to grow 5% in the entreprise/SMB part of the market and 11% in the low-end of the market over the 2020-2026 period.

Now, this is obviously a very biased figure as Covid saw volumes drop 10-15% in 2020. However, if you look at Wise’s cohort analysis, it seems that volumes haven’t fully recovered in 2021. They probably will have in 2022.

Wise had £56B in volume in 2022 for the personal segment. If we assume that the global volume for personal was £2.4T in 2022, then Wise’s market share was 2.4%. Banks still hold 66% of the market, other traditional operators such as Western Union hold 13% and other non-banks such as Paypal own 18%.

Wise clearly offers a better proposition than traditional operators and banks, and is also more competitive on price than other fintechs such as Paypal or Revolut because it specialises in cross-currency transfers. They do have some direct competitors such as Remitly, but they are much smaller. Thus, there is still so much room for Wise to gain share on traditional, banks and other fintechs.

However, taking market share from banks will take time. People are notoriously lazy in looking for alternatives to their bank, and Wise doesn’t really do any marketing in the personal segment.

In the business segment, Wise processed £19.5B in 2022. This equates to 0.25% market share. The number of customers in this segment is growing fast (>34% in 2022) and more importantly, they primarily cater to high-growth tech-enabled businesses, so the volume per customer is growing in the high single digits on average. However, the volume per customer is small on an absolute basis (48k), so these are small businesses that are probably very sensitive to the business cycle.

The competitive landscape is broad and diverse. Wise doesn’t compete for big businesses like Adyen, but they compete with the likes of Paypal, Stripe or Revolut for overall payment processing.

How do they lower costs ?

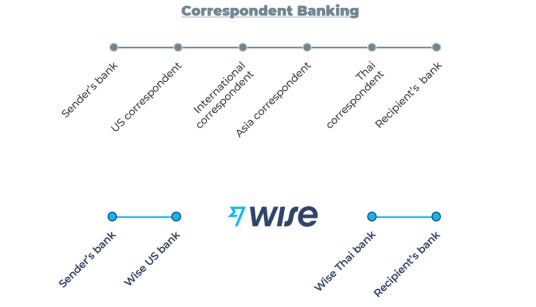

Cutting out the middleman

Most cross-border payment systems are built on top of a domestic system. Currency transfer capabilities are added progressively in an inefficient way by multiplying intermediaries and relationships. Wise, on the other hand, was built as a global platform from the start, which means that they only have 2 intermediaries: the Wise bank from country A and the Wise Banks from country B.

This creates a leaner, cheaper and predictable model.

A leaner model that works doesn’t need customer service

Wise automates a lot of back-office tasks (KYC, Customer Support). When your transfer consistently arrives on time and fast, the costs are transparent and small, and the process for creating an account is fast and reliable, you don’t need a huge amount of labor processing customer complaints.

Furthermore, this is largely a fixed cost, so as volume grows, operating leverage is strong.

Marketing

Wise marketing costs make up around 5% of turnover (down from 9% in 2019). In fact, most of that is related to the business segment as individual customers generally come to the platform by word of mouth.

This means that a business customer costs around 181 GBP to acquire (21m/110k new customers in 2021) . However, the contribution margin of a business customer is on average 170 GBP in the first year (40,400 volume per customer*0.65% take rate*64% gross margin).

With a 1 year payback, the returns are incredible even at high levels of churn.

Making sense of the costs

(2022 are estimates)

This table shows a proxy for operating cashflow ex net working capital - capitalized staff costs. In my opinion, this will get you very close to a reliable measure of potential free cashflow as NWC, Credit losses & interest income/expense are pretty random, and capex/leases are very small.

What we notice:

gross margin expansion as volume drives better fee deals with partners

Forex costs broadly stable

Significant investments in product (12-14% of sales).

Admin costs scaling down (16%→11%)

Unusually high outsourced costs in 2022 due to exceptionally high recruiting costs/IPO, but the trend is down.

Take rate has actually risen over the period but is coming down as Wise passes down economies of scale. It is much lower than it was 10 years ago so this period isn’t really representative

Note that this doesn’t include share based compensation, which was £42m pounds, or 30% of cashflow. That should scale down with the IPO being done, but 7.5% of sales/2% of market cap isn’t really egregious.

Creating a long-term competitive advantage ?

Wise are in what I would define the “Amazon virtuous cycle” :

Scale lowers unit costs → Wise lowers prices → Attracts more customers → More Scale → Lower units costs → lower prices etc…

This means that as they grow, it becomes harder to compete with them because it simply isn’t possible for competitors to offer better prices. In fact, this is what allowed Amazon to grow so big: they always passed on scale economies to customers.

Technically, this implies that this is a winner takes all market, and I think that Wise is the play as they lead for now.

Financials & Valuation

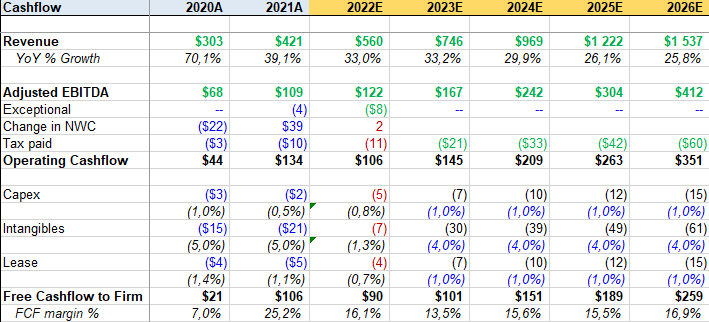

I assume that they continue to grow volume at a 30% CAGR over the next 4 years (23E-26E). They also lower their take rate from 73 bps to 67 bps.

This would imply:

SMB market share: 0.25% → 0.78%

Personal 2.4% → 5%

These extra extra 2.6% in the personnel segment can easily be found in the 66% of the share held by banks or the 13% held by WU and the likes in the personal segment.

In the business segment, i think anything under 1% is hardly a stretch.

Income statement

I assume that the gross margin stays stable around 64%, passing all the partner fees opex leverage to customers + stable forex/credit losses. (Remember, credit losses are due to the fact that they hold some transfers for a day or more - they don’t do loans).

On the other hand, I assume that admin costs scale down to 48% of revenue. This would imply an un-adjusted operating margin of 16.2% (vs 8.8% today).

Cashflow

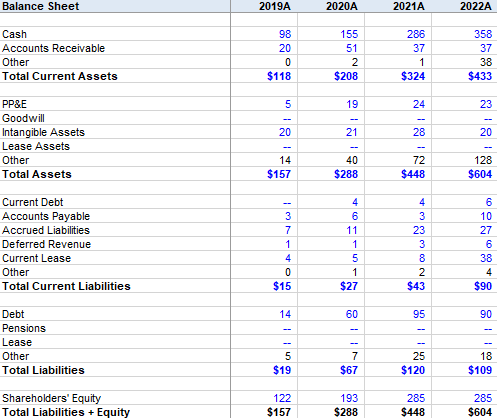

So obviously, I had to adjust the balance sheet and cashflow to extract “corporate cash”, as they hold a lot of customer deposits/liabilities on their balance sheet which are not part of the actual business but just a random photo of their customer’s activities.

Adjusted Balance Sheet

In terms of capex, leases & intangibles, I assume 6% investment per year which is in line with history. I assume NWC averages 0.

This would imply a free cashflow = EBIT.

Now obviously, this is due to share base compensation, for which I assume 2% dilution per year.

This would imply a free cashflow per share of 23p in 2026 on a current share price of 337p. Even netting 24p of excess cash from the share price, its hardly cheap, but in my opinion, 13.6x P/FCF 26E is a good deal for a high quality business that will still be growing at ~20% in 4 years probably.

The reason I think they will still be growing pretty fast is that I see them only having <1% of the small business segment, which they can scale to 2-3% pretty easily through partnerships and advertising.

Even if 5% of personal starts to be a pretty hefty share, at what point should growth stop if they are really the cheapest?

Concluding Thoughts

Wise may be the winner in the international transfers business. They benefit from more scale → lower prices → more scale virtuous cycle which should drive top-line growth through market share gains for a long period of time.

Lowering prices doesn’t have to come at the expense of operating leverage, but having the option of killing your competitors by becoming impossible to compete with on price is a great asset.

Valuation isn’t cheap @ a forward cash yield of <3%, but the long growth runway protected by the “Amazon" virtuous cycle does make up for it.