Focusrite: Cool & Niche

EU Small & Mid #3

The internet has disrupted the content industry in many ways. The birth of the semi-professional content creator is one of them. Focusrite ($TUNE) has spotted this trend early on as its flagship audio-interface, The Scarlett, has experienced tremendous growth over the past decade (26% CAGR). But more growth is yet to come, as Focusrite builds itself into the largest supplier of audio paraphernalia.

What the hell is an audio interface ?

In my previous article, I explain how the content creation industry has been disrupted by the internet, and the implications it has on the whole value chain. I invite you to read it before you continue reading this article, as it will help you understand my thesis much better:

Now that this is out of the way, let me dive a bit deeper into what the Scarlett actually does.

Sound is Analog, Music is Digital

When you listen to an mp3 track, what you are actually hearing is a digital re-creation of an analog sound. By analog, I mean a vibration in the air. Think about a clap for instance.

Instruments, such as guitars, microphones and pianos, also produce analog sounds. In order to shove all these sounds into an mp3 file, you need a way to convert this sound into a digital piece of memory. This is what an audio interface does. (Red Box Below)

Given the size of this thing, you understand why its not very economical to put one in each guitar, or even in a computer. If you want to make music or a podcast, you have to buy one.

As the amount of studios grows…

Music used to be exclusively produced in professional studios. If you have ever been into one, you might recall the memory of massive mixing boards such as these:

But, as the semi-professional content creator emerged, a smaller and cheaper version of this was needed to enable the posting of media on platforms.

Almost by accident, Focusrite became a high growth company, as it was the leader, and still is, in cheap audio interface.

Focusrite’s key product: The Scarlett

Consistent growth

The Scarlett is an emblematic product. It is known to every semi-professional musician as the best bang for buck. For roughly £200, you can set up your own home studio.

As you can imagine, aspiring musicians and podcasters aren’t going to buy the most expensive audio interface. Furthermore, some amateurs & most podcasters aren’t really going to need anything more than a cheap solution that does the job well. Therefore, most of them opt for the Scarlett. While Focusrite does offer more expensive audio interfaces, such as the Clarett, the growth has been slow, as a lot of content creators give up before they have the time to re-invest in better equipment.

The market for audio interfaces as a whole isn’t growing that fast, according to my calculations, roughly 8%. However that growth is driven by the low end, due to the increasing number of semi-professional content creators. Furthermore, as Focusrite was the leader at the time growth really picked up, it got the best positioning in store & benefits from the strongest brand value. This has helped them sell 20% more Scarletts each year on average since 2014, growing sales from £27m to £102m and taking its market share to 50% in 2021.

Locking in people with Software

To create songs digitally, one needs software to receive the data from the audio interface. Professionals use expensive software like Ableton or FL Studio, but the price tag starts at £700.

Focusrite has bundled a simplified version of this with its product, which does the job for the amateur. This creates switching costs, so the people that buy Scarletts tend to buy another one when they need it replaced. It’s worth mentioning that their is a fairly high depreciation rate for this product, as sound causes friction which damages it over time.

Growth isn’t over even though 2022 will be down

Due to its size & switching costs, I believe Focusrite will continue to dominate the low end of the market. Furthermore, As I outlined during my previous post, I expect semi-professional content to rise in quality, supporting growth acceleration in the higher end of the market.

Therefore, I estimate that the audio interface range will grow in the mid-teens up to 2026. However, the pandemic has brought a lot of demand forward, so I expect to see negative growth this year.

But its not all about the Scarlett anymore.

The Home studio Conglomerate

Novation

As the CEO puts it, the company was initially just selling a piece of hardware, and hoping people would come back in a few years to buy another one. However, this is changing, as Focusrite is expanding into new verticals and creating a whole ecosystem.

The first attempt at doing this was the purchase of Novation in 2009. The company makes a pad that plays pre-defined sounds when touched:

However, this is more of a gadget, so growth has only been 9% per year and very volatile, typical of consumer electronics. It currently makes up 13% of the group sales.

The company hasn’t really done much in the 10 years following this acquisition, as it was focused on growing the Scarlett, but that changed in 2019. Focusrite was no longer a 6m EBIT business, but a 20m EBIT business, so it had firepower to make some deals.

Growth through acquisitions

The audio equipment industry is as niche as its get. It is hard to understand the value of brand whose main product is to make £2000 speakers for professionals. Furthermore, those companies tend to be founder led and the people working in them are passionate about music. The point is, they don’t sell to PE, and PE would probably not know what to do with them.

A contrario, Focusrite has a lot of credibility, as its founder was Led Zepplin’s sound engineer. They know their space really well. Therefore, they can buy incredible assets at cheap prices and realise synergies.

They have purchased 3 assets between 2019 and 2021:

Martin Audio

Adam Audio

Sequential

Let’s take the example of Sequential. It’s founder, Dave Smith, is a rockstar in the audio industry. He invented the polyphonic synthesizer in the 70s, which basically means a synth that can play multiple notes at the same time. He then built his own synthesizer brand, which have price tags going from £1500 to multiple thousand pounds. People are prepared to pay for this because they have extremely high quality sound and a lot of brand value.

Focusrite paid £19m including £3m of earn-out. The business did £18m in sales and £5m in PBT in 2021. Though it was probably an exceptional year, that’s very cheap for what’s basically a luxury brand with 25% operating margins.

Martin Audio and Adam audio were acquired for similar prices, make similar margins and hold similar status in the audio industry. One makes speakers and the other makes concert equipment. Of course, they were all paid with cash and debt, with the debt being repaid in a year, because everything about this company is perfect.

The synergies are realised at the distribution level: Focusrite uses the acquired company’s distribution network to place its other products, and forces the acquired company’s product on its own distribution networks.

Launching new products organically

Focusrite spends roughly 7% of its sales on R&D. Most of which is capitalised. This allows them to leverage their strong distribution channels by creating new products. An example is Optimal audio, an app that manages sound in commercial spaces. Another one is Amplify, the software that is bundled with the audio interface. They recently announced that they were creating a subscription feature, allowing people to get a premium version. Launched in 2021, it has 5000 subscriptions at the time and is growing very fast.

Overall, through organic product development and acquisitions, Focusrite is attempting to build an ecosystem of brands that supply the semi-professional content creator. This will enhance its bargaining power over its distributors and create cross-selling opportunities.

The Big Picture: Cross Selling, Vertical Integration and TAM expansion

Cross Selling

Since FY2019, Focusrite reports its registered users, or the number of people that have bought one of their equipment. This is the epitome of their strategy change: They want to sell all the audio equipment the semi-professional content creator needs, from editing software to microphone.

Some aspiring content creators will give up on their dream after buying the Scarlett and basic equipment, but some will go on to upgrade to better speakers, take the software subscription, and so on and so forth. Therefore, customers have a sort of lifetime value, and that lifetime value is captured by providing an ecosystem with switching costs, ensuring the customer buys every product from a Focusrite brand.

Registered users are growing 30% per year since 2017, standing currently at 4m. Most of them are under 30, and likely to spend over £1000 on equipment over their lifetime. The conclusion I make is their is still a lot of value to capture in existing users, and more users to acquire.

Vertical Integration

The second element of the strategy is to take over the whole supply chain by acquiring suppliers and putting pressure on distributors.

Audio equipment is sold through specialised retailers such as Thoman. As Focusrite becomes an increasing portion of their sales, bargaining power increases. This will allow them to get the best spots for their products and to negotiate better deals.

Moreover, they are trying to sell directly to the consumer, and have experienced a fair amount of success as the pandemic helped their e-commerce sales.

Finally, they have routinely bought small suppliers, and I expect that to continue as they try to gain control over the supply chain. There are very few high-quality players in some of the sub-categories of audio equipment supplies, so owning them creates barriers to entry.

Beyond the semi-professional

By acquiring Martin Audio, Focusrite entered the live venue market (worth around £2B). Though it is unrelated to their core expansion plan, management shows it is not shy of jumping on opportunities when they appear. I believe they will seize other TAM expansion opportunities like this in the future, expanding into other verticals of the audio equipment industry.

Overall, by increasing its control over the small niche industry of audio equipment, Focusrite is creating a strong moat. I believe it will continue to gain share and operating leverage as the moat expands.

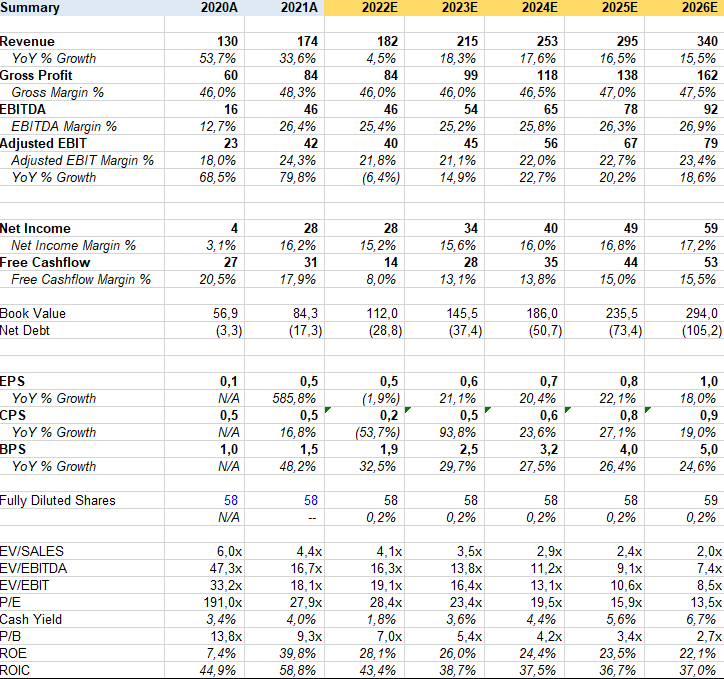

Translating the story into numbers: Double digit growth with operating leverage

Growth & Margins

Organically, I see the Scarlett continuing to grow at 15% CAGR in 2023-2026, taking market share closer to 60%. I see 6% growth for the other segments of the group (slightly above market average), but that could prove to be conservative.

I model 4 acquisitions, roughly the same size as the 3 acquisitions in 2019-2021. This would add roughly £70m in revenue, if we take the same multiples.

Furthermore, increased bargaining power, cost synergies and vertical integration could help them reach the same level of margin they have today again. (which is exceptional due to a tax thing and unusual volume growth).

The company currently has no debt, and generates enough cash to accomplish its plan.

Valuation

At £13.5, or 19x 22E EV/EBIT, it is certainly not cheap. But I think its worth paying for given the long growth runway. The company currently defines its TAM as £4.6B, growing in the mid-single digits overall. I don’t see what prevents them from taking 10-20% market share in the long run, and growing the business to £1 billion in sales.

Below is a breakdown of their TAM:

Conclusion

Focusrite is the best way to play the content enabler thesis. It enjoys a dominant position in the audio interface segment, the crux of the audio equipment market, on top of which it is building an audio equipment ecosystem. Through acquisitions and organic product development, the company will attempt to supply all the products needed for a home studio.

At 19x Forward EBIT, it is not cheap, but its a quality asset worth paying for as it can sustain double digit growth for a long time and very high returns on invested capital.