Enquest: The Ugly Duckling

EU Small Mid #6

Enquest PLC (ENQ) is an independent oil & gas exploration and production company trading on the LSE. It looks extremely cheap at a forward P/E under 2. Even when considering the risks of the e&p business and the sensitivity to oil prices, the risk-reward is attractive especially if one has a bullish bias on O&G prices in the next five years. It has sold off 10% following the new tax reform in the UK aimed at curbing O&G profits, but is trading at the lowest multiple it has ever traded, even though the business is significantly stronger than it has ever been.

Why Oil & Gas could be more than a short term trade

When we look at small caps, we typically look for high quality companies with defensible business models benefiting from secular growth. This often leads us into tech healthcare and consumer discretionary, because they are the most obvious places to look at.

However, if we refer to the work of Chris Mayer on stocks that went up 100x, there is no significant sector bias that warrants avoiding all the other ones. So yeah, O&G isn’t very sexy, but there are opportunities here.

Though I understand many readers won’t be investing at all in the O&G industry, I still think this article provides value for those that are curious about how Oil & Gas works. Personally, I have learned a lot from this exercise and I hope you do too.

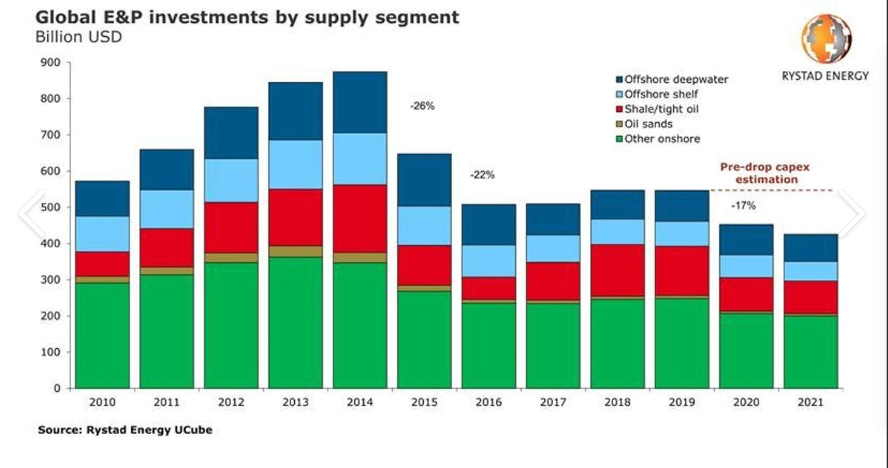

Oil & Gas has been under severe pressure in the past decade. 2016 was a brutal downturn for the industry, Covid saw the price of Oil futures go negative and ESG has significantly drained capital away from the industry. Oil investments have been declining over the past decade and declined even more recently due to Covid:

Yet, we still need oil & gas for electricity, plastics and fuel, and the demand has actually been rising. The energy transition will come, but oil & gas won’t go away overnight.

This table shows the global oil demand in barrels of oil per day

In my view, this creates a very attractive situation for incumbents, with new entrants and investment deterred by environmental concerns, but on the other hand a demand that is steadily rising.

Though I expect huge amounts of volatility, I think its fair to assume Oil will trade higher on average in the next 10 years than it did in the past 10 years. I think this leads to higher margins for E&P companies and higher returns on capex. On the other hand, multiples imply quite the opposite, perhaps creating an opportunity.

Enquest PLC

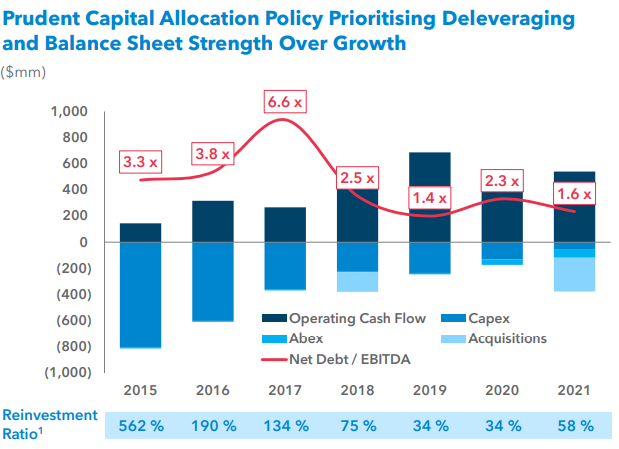

Enquest was formed in 2010 by a merger between Petrofac and Lundin Petroleum. It is involved in the exploration and production of oil & gas. The first few years of trading (2010-2015) saw Enquest leveraging the balance sheet to make a lot of investments, and then the focus shifted to deleveraging and smaller, more opportunistic investments.

Enquest currently operates assets in the North Sea and Malaysia, with 2P ressources of 194 mm boe and 2C ressources of 402 mm boe.

boe : barrels of oil equivalent. This is a metric that allows for an equivalence between natural gas and oil in terms of units.

2P: Proven and probable reserves. Hydrocarbons that are at least highly likely to be extractable and commercial (>50%)

2C: Contigent ressources. Hydrocarbons that are as likely to be extractable and commercial as 2P, but are contigent on some sort of capex/technology to begin extraction.

With a current diluted shares outstanding of 1.761b and a share price of $0.336 (27.8 GBp), you get a market cap of $591mm. Add $1.22B of net debt to get an EV of $1.8B. That’s roughly $9.3 of EV per 2P reserves and $3 per 2P+2C reserves. This is a >40% discount to M&A multiples in other countries, and translates to an over 100% cash yield for 2022.

However, I wouldn’t expect multiple expansion given that European investors are significantly more “ESG conscious”, but I also won’t assume it contracts as this would be a bit ridiculous.

Production Outlook (without further acquisitions)

Methodology:

Using company information, I make a rough estimate of the production, reserves and cash costs associated with each well. To be conservative, I estimate that 2P & 2C reserves are 60% likely to be commercial, which means that for each barrel drawn, I substract 1/0.6 barrels from the reserve.

Magnus

Magnus is one of their two main North Sea assets. In 2021, it produced 11.8k boe per day. It was acquired from BP in 2017 for $100m in cash and $200m in deffered consideration which was fully settled last year. Enquest also owes 50% of the site’s cashflow to BP, capped at a cumulative $1B. I estimate that this site contributes 65-70m boe in 2P reserves. Since acquiring it, Enquest has managed to create a huge amount of value by reducing opex by 60% to $24 per boe.

At the current rate, Magnus is set to produce 14k boe per day, or 5.11m barrels of oil equivalents per year. I chose to project that rate of production up to 2026, giving the site a ~12 year lifespan. Given 2C ressources of 35m boe, and taking guidance for next year, i estimate that drilling will add 3m boe in 2022 and 1m p.a over 2022-2026 in 2P ressources at a cost of $10 per boe. This leaves 42m boe in 2P and 23m in 2C in 2026.

Kraken

Kraken is currently their highest producing north sea asset, with 22k boepd in 2021. I estimate that there are 35m 2P ressources left to produce as of today. They have a 70.5% interest in the site.

I do not factor any additions and further drilling, but they are exploring possibilities currently though I think they count these in “Other UK”. In the meantime, the well’s production is expected to decline over the next few years as they exhaust the ressources. Unit economics (which I estimate at $21 per barrel), will decline progressively with negative operating leverage to $24 a barrel.

I forecast 6.4m boe in 2022 & 2023, 5.8m boe in 2024 and 4m boe in 2025 when the well is exhausted.

Golden Eagle

Enquest acquired a 26.7% interest in this site in FY 21 for around $200mm.

It’s run-rate should be around 7.2k boepd in the next few years, with 19m 2P ressources and double that in 2C ressources. I forecast that 2P ressources will grow by 2m boe every year and assume $10 per barrel of extraction. Cash opex is very low ($10 per boe). This leaves 23.3m in 2C and 9.5M in 2P in 2026.

Malaysia

Malaysia has around 19m in 2P ressources but 86m in 2C ressources and significant drilling is forecasted, which is why I add 4m boe per year in 2P per year. I estimate that it will be able to produce 7.5k boepd. Extraction costs are also lower than in the north sea ($8 per boe). Opex is around $20 per barrel. This leaves 17m boe in 2P and 51.7m in 2C in 2026

Other UK

Enquest owns an interest in a number of early stage sites in the north sea. I estimate that there are currently 51m 2P ressources and 246m 2C ressources. The production is only 4.158k boepd but I forecast it will progressively double in 2022-2026 due to the high drilling activity (9m boe per year). I estimate opex to be around $30 per barrel, but I see it go down to $25 to match the north sea average as production scales up.

This leaves 171 in 2C in 2026 and 74m in 2P in 2026.

Total

I assume a conservative $3 per barrel in transportation cost.

Below is the aggregate of all the estimates I made:

Revenue & PnL

So the big problem with oil & gas companies is the volatile O&G price, which is hard to forecast. They have hedged a significant number of barrels for 2022 (44% of production) and some for 2023 using cash-less collars, which basically cap the price they realize in a range ($65-$78 for 2022).

For the other barrels, I assume a price of $67 on average, except for 2022 where I assume $100

I subtract 50% of the magnus related profits to account for the bp profit share, capped at $1B.

Adding up opex, capex, $75m of abandonment expenditure and subtracting it from revenue gives us the following base case pre-interest & tax cashflow:

Since Enquest has $3B in Net operating losses, even with out including the interest tax shield, we see that they most likely won’t pay any taxes in the $67 average oil price base case.

However, since the windfall tax was introduced, they will pay 25% of pre-tax profits, but I think its fair to assume the tax will go away if oil prices “normalize”. Nevertheless, I apply the tax to my forecast.

The 2023 Bond re-financing scenario under $65 oil conditions

The real catalyst of this thesis is successful refinancing of the 2023 High-Yield Bond, and the entity that it will create.

Let’s assume oil stays around $100 on average for 2022. That should allow Enquest to realize around $70 of cash margin per barrel of oil on average. Subtracting Interest, taxes, finance leases, capex & abex should give ~$550mm dollars of free cashflow.

Furthermore, assume they raise $1B from a 12% cash interest bond maturing in 2027. They use the proceeds to retire all outstanding debt.

This would create a net debt position of $661 at the end of 2022. Adding the current market cap of $590 and you get an EV of $1251mm.

Given normalized oil prices of $67, Enquest should generate ~200mm in FCF in 2023. That would imply an EV/FCF multiple of 6x for normalized oil prices at 2022 EoY, and a cash yield of 34%. For normalized oil prices, I think this looks pretty good, taking into account the fact that the windfall tax may go away.

This is why I think it pays to hold Enquest for a year, because the new entity with reduced debt and a refinanced high-yield bond will look extremely attractive at current prices and could re-rate by 100% to a 15% cash yield.

Obviously, for every dollar of positive surprise in average oil prices, 75 cents/pboe flow to the bottom line, so you get that option to on top of owning a solid E&P company at a 34% cash yield.

Concluding Thoughts

The risk reward seems very attractive to me. The stock is cheap at pre-covid oil price averages, and there is lots of upside if oil goes parabolic in the next few years.

Also, I believe it is important to stress that Enquest has very good re-investment opportunities, being an expert in the North Sea and facing very low competition. This is an important competitive advantage. Capex is 90% tax deductible under the windfall tax, so they do have an incentive to reinvest.

If they manage to refinance their 2023 bond, they will be in a position to invest in attractive projects while returning significant cash to shareholders.