Alfen: Hypergrowth In Energy

EU Small & Mid #4

I think Alfen is the best stock to play the European Energy transition, as it provides exposure to multiple verticals and is already very profitable. However, there are significant uncertainties in the main variables. That’s why I don’t own the stock yet, but its definitely worth following.

Price at the time of the article: 90€

Definitions:

Europe : EU+EFTA+UK

EVS: PHEV/BEV

Right Place, Right Time

Alfen was founded in 1937 somewhere in the Netherlands. It manufactured high/low voltage switching equipment. As the demand for electricity grew, driving the need for increasingly complex energy related equipment, Alfen adapted its offering and stayed on top of innovation. Everything is developed and produced in-house. They started making secondary transformer substations in 1968, electric vehicle charging points in 2009 and battery storage equipment in 2011. It’s definitely not the EV charging start-up ran by a 27 year business school graduate.

In the past 10 years, Alfen’s vision has been to build the capacity to manufacture the equipment needed for the new energy infrastructure. The energy transition does not only imply changing the source of energy, but also the way we access it and store it. Renewable is likely to be spread out and significantly less reliable, which will increase grid complexity and the need for efficient storage solutions.

Alfen seeks to be involved in every aspect of this process, from power generation to use. It is currently has three distinct lines of business:

Energy Storage: (8%)

Smart Grid Solutions ( 51%)

EV Charging Equipment (41%)

As a one stop shop solution, it has a competitive advantage over players that specialise in one segment, because it can help large utilities, governments and corporations with every aspect of their energy transition, simplifying the task. It’s also easier for them to cross-sell energy storage solutions to someone who has been a customer of smart grids for example, than for a new entrant to sell an energy storage solution to the same customer.

Alfen views itself as a supplier of bits and pieces of large infrastructure projects, rather than selling three different types of products. That makes sense in theory, although I noted that there isn’t an extremely high degree of overlap in each segment’s customers. Therefore, I review each line of business separately.

EV Charging

A great set of circumstances

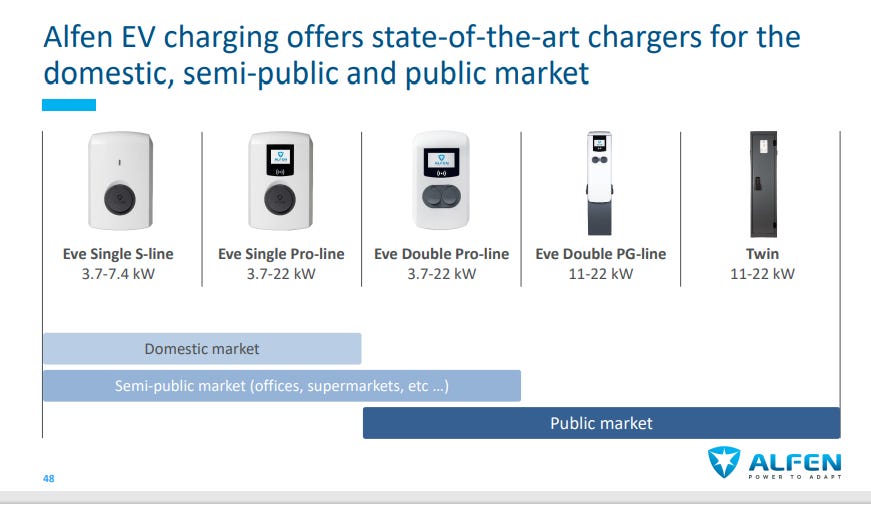

Alfen sells charging equipment destined for public usage, private usage, and everything in between.

In 2020 and 2021, the adoption of electric vehicles in Europe sharply accelerated. New registrations were up 44% in 2019, 139% in 2020 and 66% in 2021. However, the European charging stock has not quite followed.

The public charging stock is ~340,000 as of Q4 2021, and I estimate that there are currently >6m EVs on the road in europe (Q1 2022). This is really far from the European Union’s target of one charger per six EV.

Moreover, many analysts say that if you include non-public charging stations, the terminal ratio should be closer to 1-1. The EU estimated in late 2020 that there were about 3 private chargers for every public charger, which takes us to 1.6m chargers as of Q1 2022, or 1 charger per 4 EVs in total.

Basically, if we believe the ratio hasn’t changed, the stock of charging stations in Europe is going to have to go up 4 times just to meet the current demand, and much more to meet the future demand.

However, there is a problem: the capacity is just not there in the short term and supply chain issues are not helping.

This situation is basically a gift from heaven for Alfen, as it was one of the early movers in this space, and is now the dominant force in continental Europe, which has the most growth runway. It is able to increase production much faster than its peers, and is already very profitable, which isn’t the case for smaller start-ups. The market needs chargers now, not in 5 years, to the detriment of unprofitable smaller ventures that are still burning cash and need to raise to scale. Many of them are actually losing contracts to Alfen.

Furthermore, large customers prefer working with a large, profitable, publicly traded player, because it is more unlikely that it will go bust, and that the relationship will be stable and long-term.

In consequence, Alfen is currently eating all the market share. I estimate that roughly 200,000 charging points were added in Q1 in Europe, and Alfen made 64,000. This situation won’t last forever, but it can definitely last long enough for Alfen to grow its revenues & profits from this segment much faster than what the already bullish investors are estimating.

Forecasts

Asp Assumptions

Using Alfen’s prospectus, I was able to figure out a decent estimate (+/- 5%) for ASP and maintenance revenue. I believe that Alfen makes around 925€ per unit, and recieves a 19€ p/a revenue per unit in its installed base.

Car Market Assumptions

The average car lasts 12 years, so theoretically, the number of cars sold in a given year should be about the same as the number of cars that were sold 12 years prior. Population growth in Europe should be offset by less drivers in big cities, making the stock of cars needed relatively constant over time.

The 12y relationship has been extremely precise in 2014-2019 (the further you go back in time, the less durable cars were, so no point in going further). However, the correlation completely broke in 2020 and 2021.

The explanation is obviously not a sudden change in long term demand, but supply chain issues. The proof of that is the sudden explosion in used car prices.

In 2020 and 2021, the number of cars sold were about 80% of the forecasted values, and are set to be closer to 76% of the forecasted values in 2022.

Assuming the supply-chain bottlenecks last for two more years, we could see supply only be able to meet 70% of demand for a while, but there are likely to be years where the car market sales are 130-140% of what they should have been when the situation ends.

I take this as my base case for the car market:

EV Market Share Assumptions:

The European Union has a target of 30m EVs on the road by 2030. If you add the UK and EFTA countries, that takes you closer to 40m.

I assume that there will be around 28m EVs on the road in Europe in 2026. In order to meet that target, the number of EVs registered per year has to go from 2.3m in 2021 to 6.7m in 2026. At that moment, Evs will account for 45% of new car sales.

The Charging Station Market & Alfen

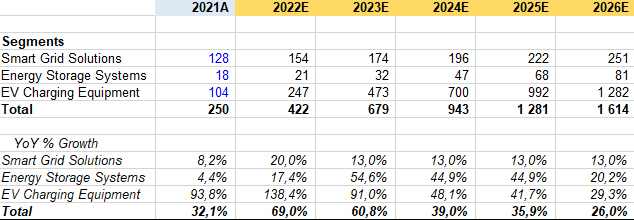

Eventually, the ratio of charging points to EVs on the road will be around 1, but I assume that it will reach 11 to 20 in 2026. Assuming Alfen’s share decreases as competition catches up, we get roughly 1.3B€ in revenues in 2026.

Of course, this estimate is contingent on supply. As of Q1, Alfen is producing 260,000 substations on an annualised basis. They mentioned that they increased capacity by 5x in the august 2020 earnings call and the ipo capacity was 90,000.

So, in theory, the capacity may only be 450,000 per year on the low side. This means that they would have to 4x the capacity again to meet the demand.

Smart Grid Solutions

In this segment, Alfen produces substations and microgrids.

Typically, economic agents are connected to a single grid, powered by some sort of central station such as a coal powerplant. The advantage of microgrids is that they can run independently, and are more adapted to a decentralised urban zone than a typical grid. More here. The typical customers of Alfen tend to be industrial clients or horticulturalists, to which energy stability is critical and need to diversify from the grid.

Alfen has a large market share in the Netherlands, as they have contracts with the 3 largest DSOs (ex: Stedin). However, they have diversified since the IPO, when only 8% of the revenues in this segment were coming from outside the Netherlands.

Alfen manufactures the substation, sells it, and charges service revenues which were equal to around 14% of sales in 2017. Thus, maintenance is a much higher component of sales in this sector than it is in the two other segments. I tried to find a reliable estimate for asp/maintenance per base, but it seems that the product/contract mix is very heterogeneous and that the timing of revenue recognition is complex. Therefore, its kind of hard to put a clear estimate on this segment.

Alfen expects demand from its Dutch clients to grow at roughly 12% p.a. Furthermore, management mentions that covid made on-site installations difficult, so this probably explains the 14% and 8% growth in the last two years.

I think that assuming a 20% growth in 2022 and a 13% CAGR in 2023-2026 should be a reasonable assumption. This would make sales double over 2021-2026. Obviously, there is upside, as Alfen mentioned 10-40% revenue growth in this segment during there capital markets day. However, I am fundamentally less bullish on Solar/Wind then I am on EVs, so I’m happy to have a downward bias here.

Energy Storage

Alfen produces and develops in-house modular energy storage systems, and the majority of the sale in this segment come from outside the Netherlands. 100% of the revenue is project-based and 5% of the value of each contract is attributable to 10-year maintenance services.

There are basically 3 types of products:

Residential storage systems (small capacity)

Commercial storage systems (medium capacity)

Large storage systems

Alfen is mostly active in the commercial and industrial part of the market, which has been growing the slowest and was heavily affected by the pandemic.

Nonetheless, the switch to renewable energies and above all, electric vehicles is going to drive exponential growth in this segment. As you can see below, the C&I segment has clearly been lagging, and I expect a catch up.

I estimate that Alfen makes roughly 1.1m€ per incremental MWh installed, and that the maintenance portion of the contracts are 100,000€ over 10 years.

Using number of 7.4 Mwh installed in 2017, i get a total installed base of 64.4Mwh in 2021. See below how Alfen lost market share in line with the lag of C&I.

Assuming the market grows 25% p.a over 2021-2026, and that Alfen gains share as C&I catches up (1.3% share in 2026), revenues from energy storage would be 81m in 2026, up from 18m in 2021.

Overall Revenue Growth

For starters, Alfen’s revenue guidance is 330m-370m in 2022. To me, that sounds really conservative and unlikely given what I estimate for EV charging equipment.

However, a lot of the variance could come from Smart Grid Solutions.

Also, my estimate for EV charging could be way off, even though I doubt that. To put the EV charging revenue number in perspective, it implies that Alfen will produce around as many charging stations in Q2-Q4 as in Q1.

Regarding the following years, Alfen’s revenue growth guidance for the medium term stated at the 2019 capital markets day was 40%. My estimate yields 41% 2019-2026 CAGR, so I’m not out of touch with management comments.

Therefore, even if the forecast sounds a bit crazy, it makes sense to me.

Margins

Alfen has seen significant operating leverage. Some has been driven by product mix ( EV charging is slightly higher gross margin ~40%, vs Smart grid ~30%), and some by leveraging fixed costs. Gross Margin expansion has been the early margin driver as the business scaled EV charging, but since 2020 and going forward, management guides for fixed costs to grow slower than sales.

I expect gross margins to end up around 38% in 2026, from 36% in 2021, driven by product mix. In the short term, ramping up of EV charging and supply chain issues will cause pressures however.

Therefore, I expect gross margin to decline initially in 2022 and 2023 and then reach 38% in 2026. On the other hand, I expect fixed cost leverage to counterbalance this decline, leading to a steady 13-14% operating margin in the next few years, expanding towards >17% in 2026.

Cash Conversion

Though Capex is guided to remain below 3%, I don’t expect the company to generate a lot of cash as it will have to build inventory fast. Furthermore, any cash that is generated could be used for acquisitions of patents or other businesses to boost growth and gain new clients. Thus, I expect the company to convert 60% of its operating income into cash.

Obviously, once growth slows down to 10-20% in the later part of the decade, I think that cash conversion will go up substantially.

Valuation and Concluding Thoughts

At 91x trailing earnings, the stock looks extremely expensive. I have to agree that there isn’t much of a margin of safety.

I guess the investment thesis relies on 2 key points: Is the EV charging market under-supplied by a factor of 4x, and does Alfen have the capacity to produce ~2m chargers per year by 2026?

If the answer to these two questions is yes, then I think that these three near-certainties support the forecasts:

Large customers will want to work with Alfen rather than a no-name start-up, especially those in need of storage & grid.

The EV market will continue to grow towards >40m cars

Operating leverage will allow for 17% operating margins.

Thus, paying 5.1x 2026 EBIT is actually cheap, as the business will still have a high double digit growth profile in 2026, given that the market will continue to grow fast. Taking a 20x EBIT multiple and assuming you get some cash back along the way, that’s over 300% returns. Not bad.