DiscoverIE: A Primer On Serial Acquirers

EU Small & Mid #7

What is a serial acquirer and why are those great businesses to own ?

Some businesses are actually in the business of buying other businesses, which sounds a lot like PE. But there are two key differences:

Serial acquirers would prefer not to sell ever, and have permanent capital in the form of a publicly traded equity.

Serial acquirers often start as a stand-alone operating businesses within a niche of a specific industry, and slowly expand the business into adjacent verticals through M&A. They don’t start with X amount of cash to deploy. They are often industry experts vs. financiers

The market loves serial acquirers. As a matter of fact, their very existence is a testament to their success: can’t keep buying everything if its not working !

There are a few reasons why the market tends to reward these companies with ever-appreciating stock prices:

Markets love consistency.

It’s much easier to control your growth rate/margins when you are buying incremental sales instead of trying to generate them exclusively through organic channels.

Generally, serial acquirers get on a pace. In fact, theory would suggest that given an unlimited amount of targets, the amount they spend on acquisitions as a % of their levered free cash flow should reach an equilibrium, creating a consistent growth rate.

Accordingly, markets tend to place a higher multiple on the growth of serial acquirers because it’s more certain.

Multiples tend to expand to elevated levels creating “multiple arbitrage”.

As per the previous argument, consistent serial acquirers tend to get rewarded with high valuations. However, they pay much lower multiples for the businesses they buy, and the multiples they pay don’t change a lot as they are reflective of broader market multiples.

This implies that the more expensive their equity gets, the more value they can create through M&A via immediate earnings accretion, which makes it easier for investors to justify elevated valuations, which helps the stock stay expensive when it gets there.

Keep in mind however, this can also work in reverse, so buying stable businesses is a must, as a major hiccup could send the valuation to levels at which acquisitions are dilutive.

They always have something to do with their cash

No need for buybacks & dividends (even though some of them still do it, which is unfortunate). They can invest their excess cash at rates of return that far exceed their cost of capital. Ideally, they use leverage to juice up equity returns.

Business fundamentals improve

When you think about it, the underlying process that serial acquirers are engaged in is industry consolidation. Therefore, at some scale, the businesses consolidated are worth more than their sum. Synergies include cross-selling opportunities, a better understanding of the overall market trends, additional client relationships, potential opportunities to improve production efficiency & back office economies of scale.

Diversification Benefits

As serial acquirers enter different niches within an industry, they increase the number of end markets and geographies they cater to, reducing organic growth volatility. Additionally, they are more likely to identify attractive niches early and have the flexibility to buy into them.

The company we are going to talk about today, DiscoverIE, is probably the epitome of the flexibility growing through acquisition provides. Through M&A, it’s possible to transform a no growth business in a terrible segment of the market into a secular growth/high margin business.

Buying your spot on the top: DiscoverIE PLC

Acal BFi was an unremarkable business. As a supplier of electronic components, it did not have much of an advantage over its competitors & growth opportunities were limited at best.

During the GFC, the business almost went bankrupt, and Nick Jefferies took over the group. As an ex-engineer, he knows the market for electronic components very well, but he also has really good business acumen, which makes him a perfect fit.

However, he realized that to create long-term wealth, Acal BFi had to pivot out of the supplier business and into the design & manufacturing business. D&M is much more capital intensive, but the advantage of owning the intangible more than makes up for this.

Moreover, design & manufacturing of small electronic components is a fragmented & growing $80b dollar market, with ample room for consolidation. The group was renamed DiscoverIE to reflect the change in strategy.

DiscoverIE made its first acquisition in the space c. 2014, Aramys SAS (~7x EBIT), which went on to grow its EBIT at a 25% CAGR over the next 6 years. Over time and 17 acquisitions later, the group fully divested the supplier business and grew its design and manufacturing operations from £0 to £379m in turnover.

What I like about their capital allocation is that management has not been blinded by short-term accretion/dilution concerns. The focus has always been on accretion to long-term returns on capital employed, and buying businesses that raise the group’s overall quality, even if that meant substantial dilution in the short term.

Since the stock is up over 150% in the last 8 years, I think it’s fair to say the strategy was a success. This may not seem like a lot, but they started out with a business that would probably be worth 25% of the current market today if nothing had been done.

However, now that the business is exclusively comprised of high quality compounders, they have enough firepower to avoid diluting shareholders for acquisitions (even though I suspect they may still do it if the stock runs ahead of itself). Considering their track record, I think it’s fair to assume higher returns in the next decade.

What does DiscoverIE do exactly ?

DiscoverIE supplies OEMs with small electronic components. Generally, the component is a very small part of the overall cost of the product, with the average price of a unit around £50.

When they begin working with a customer, it often takes years for the product to be approved and manufacturing to start, especially if the customer is a healthcare company. However, they typically enjoy 5-7 years of repeat buying once production starts.

Though their products are cheap, they are often relatively important components of the overall project, so customers aren’t incentivized to look elsewhere for value. As long as DiscoverIE delivers at a reasonable price, customers will keep ordering from them.

They target 4 different end markets: Renewable Energy, Healthcare, Transportation & Industrial, but the products they sell tend to be very similar across these markets.

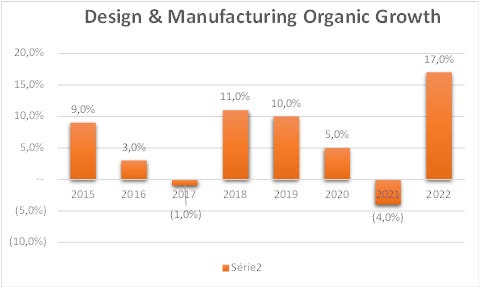

Overall, organic growth has averaged 6-7%, but strategically increasing their exposure to growing end markets such as Renewable Energy over time has improved the organic growth profile, and I think assuming >7% organic growth going forward is very reasonable.

Sales are very diversified geographically, and they are looking to continue expanding outside of Europe:

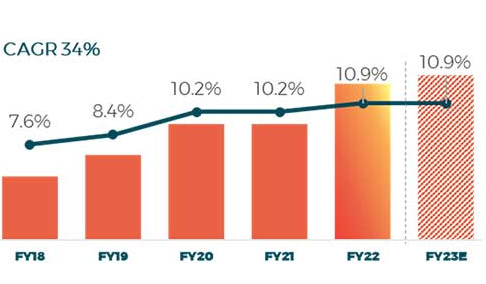

Operating Margins currently stand at 10,9% (11,2% according to my definition, but that’s immaterial).

I estimate that roughly 1/4 of the above margin expansion is due to production efficiency and 3/4 is due to mix, as incremental acquisitions have higher margins than the group average.

A deeper look a their acquisitions

The graph below shows the cash-on-cash returns of their acquisitions, assuming they can sell the business at the same multiple today (as of March 2021):

IRRs:

As you can see, they have consistently generated IRRs > 15% for a minimum holding period of 5 years. As of FY21, 64% of the cumulative purchase price of the 2014-2019 acquisitions had be returned in the form of NOPAT, and the businesses had grown 95% organically. Also, keep in mind 2021 was the fiscal year of COVID (March End), so those IRRs would look better if the computation was done for 2022.

In terms of leverage, they invested 200% of their FCF over that timeframe in acquisitions. ~90% of the extra capital came from share issues, and 10% came from debt. I would expect that ratio to invert over the next decade.

Forecasts and Valuation

This is a rather interesting exercise: how do you value a company that creates most of its value through M&A?

A lot of analysts would just forecast the organic growth, but that is rather lazy & leads to systematic undervaluation.

Instead, we can assume a re-investment rate, an optimal leverage ratio & an average profile for the business they acquire. These are the parameters I assumed:

Organic growth: 7%

Organic growth acceleration: 20bps p.a (e.g buying higher growth businesses)

Working Capital: 13%

Interest rate 6%

Taxes 25%. I used 20% in the model because I didn’t include amortisation of acquired intangibles, which should decrease taxable income by roughly 5% every year.

Organic operating leverage: 20 bps p.a

Optimal gearing 1.7x Net Debt / EBITDA

Target company profile:

10x EBIT

10% Organic growth

15% Operating Margin

2023:

10% organic growth (17% in Q1 so far)

no organic operating leverage

Antenova will add £4m in sales, £0.5m in operating profit

Beacon will add £10m in sales, £1.2m in operating profit

Exit Multiple:

20x LTM EBIT, a discount to high quality acquirers such as Halma, which should equal to 16-17x Forward EBIT.

The model finds a 25% IRR.

However, the model assumes that DiscoverIE gets to an optimal growth rate and holds it. In reality, years will be unequal and macro events will happen, preventing DiscoverIE from achieving this forecast. But I think this gives a good, rough idea of the value they can create in the future.

Conclusion:

Overall, DiscoverIE is a solid compounder to own, lead by a great capital allocator. Even if it isn’t the highest quality serial acquirer, it has a lot of potential in terms of margin expansion & is probably a bit overlooked, as it doesn’t screen very well (negative FY22 growth rate due to custom supply divestment).

I think shareholders will do well.

Disclaimer: I do not hold a position, but may initiate a position in DiscoverIE shares in the near future.